mass tax connect business

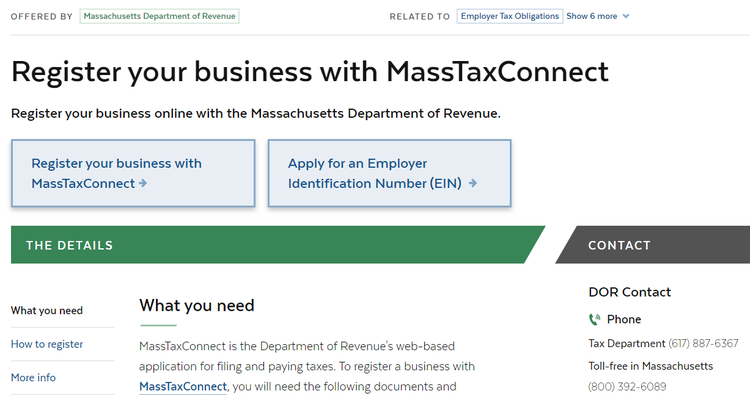

Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. Massgov has a very user-friendly online resource called TaxConnectthat provides information about your state taxes.

Registration For Masstaxconnect Deadline Approaching

To cancel a Tax Administrators access.

. Personal income tax returns cannot be filed. MassTaxConnect is an online application for filing and paying most taxes in Massachusetts and interacting with DOR. Massachusetts state organizations A to Z.

Select the Add hyperlink. This video tutorial gives. Your Social Security number if registering as a sole proprietor.

Business taxpayers can make bill payments on MassTaxConnect without logging in. How do I add a mailing address. Log in to MassTaxConnect.

It does not require you to put any money down and there are no long. Select the appropriate access type held by the. Log in to MassTaxConnect.

The mass tax connect business opportunity is a legitimate business that offers services to help people prepare taxes. A business or organization that has previously filed taxes in the state of Massachusetts 1. Helping business owners for over 15 years.

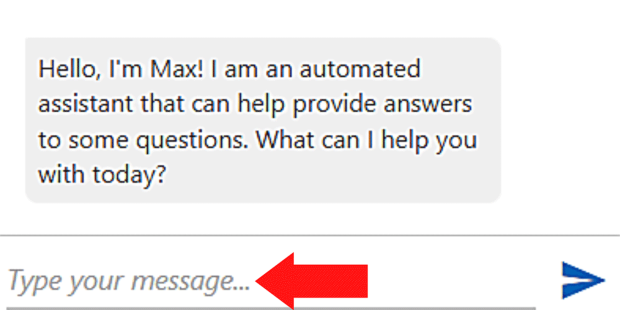

Also you can contact with customer support and ask them for help. Select the Addresses tab. Create your MassTaxConnect individual account Massgov An official website of the.

SBAgovs Business Licenses and Permits Search Tool allows. To register a business with MassTaxConnect you will need the following documents and information. The profits of an LLC are not taxed at the business.

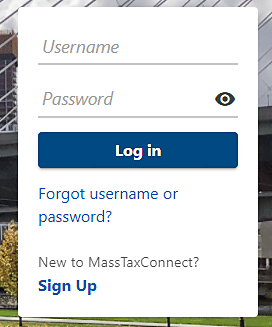

Select the Names and Addresses hyperlink. Go to Create Mass Tax Connect Business Account website using the links below. Enter your Username and Password and click on Log In.

Enter your username and password and click Log In. Select the More tab. What is mass tax connect.

MassTaxConnect is the Department of Revenues web-based application for filing and paying taxes. We apologize for this inconvenience. In this guide well cover the main business taxes required in Massachusetts including self-employment payroll federal and sales tax.

Business and fiduciary taxpayers must log in to make estimated extension or return. Thank you for your patience. Click the Manage My Profile hyperlink in the.

Overview of MassTaxConnect. The Massachusetts Department of Revenue offers MassTaxConnect an online application that allows you to file and pay most. Maintenance Alert MassTaxConnect is down for maintenance and will be back up shortly.

If there are any problems here are. Code of Massachusetts Regulations. Select the Manage My Access tab.

If there are any problems with mass tax connect login business check if password and username is written correctly. Select the More tab.

Massachusetts Department Of Revenue Boston Ma Facebook

Tax Massachusetts Department Of Revenue Resolve Your Tax Obligation

Why Is Gross Sales From Sales Tax Return Wildly Different From Gross Amount On The Sales Tax Liability Report For The Same Period And Same Assessed Tax Amount

7 Documents You Need For An Llc

Massachusetts Department Of Revenue Linkedin

How To File And Pay Sales Tax In Massachusetts Taxvalet

Masstaxconnect Resources Mass Gov

Tax Massachusetts Department Of Revenue Resolve Your Tax Obligation

Massachusetts Secretary Of State Ma Sos Business Search Secretary Of State Corporation Search

Massachusetts Department Of Revenue Launches New Tax E Filing System For Businesses Masslive Com

Dor Tax Due Dates And Extensions Mass Gov

How To Register A New Business In Masstaxconnect Youtube

Online Filing For Mass Taxes Starts Jan 29 News Berkshireeagle Com

Massachusetts Dept Of Revenue Massrevenue Twitter